World shares were mixed on Monday while oil prices pushed higher after the Israeli military said that projectiles fired from Gaza set off sirens in central Tel Aviv, as Israel marked a year since the Oct. 7 attack by Hamas.

After a day of strong gains in Asia, shares fell in Europe. The CAC 40 in Paris edged 0.1% lower to 7,530.43. Germany’s DAX lost 0.3% to 19,059.46 and the FTSE 100 in London was down 0.1% at 8,275.18.

The futures for the S&P 500 and the Dow Jones Industrial Average were down 0.4%.

Asian shares logged strong gains after a surprisingly strong U.S. jobs report raised optimism about the economy, sparking a rally Friday on Wall Street.

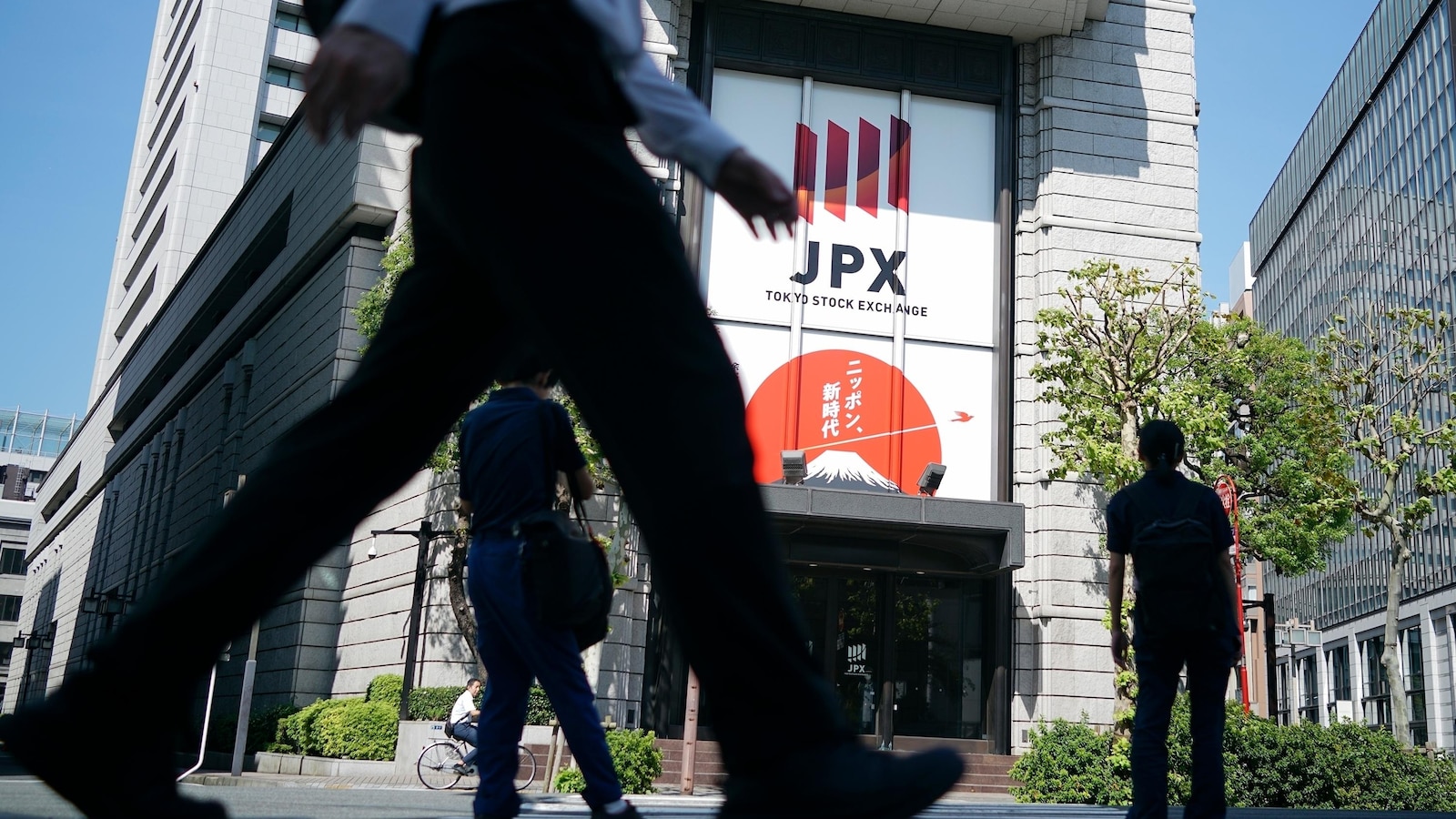

Japan’s Nikkei 225 index gained 1.8% to 39,332.74 after the yen sank against the U.S. dollar. The Japanese currency has bounced on speculation over the central bank’s plans for interest rates since Prime Minister Shigeru Ishiba took office last week. Lower interest rates tend to boost prices of shares and other asset, and both Ishiba and the central bank governor suggested no hikes were likely soon.

Nintendo gained 4.4% following reports that a Saudi wealth fund was planning to increase its investment in the Kyoto, Japan-based video game maker.

In a policy speech on Friday, Ishiba said he wants to see salary increases that outpace inflation and that he will promote investment to create “a virtuous cycle of growth and distribution.” He promised economic support for low-income households and measures for regional revitalization and disaster resilience.

But he offered no major new initiatives, and his initial public support ratings are around 50% or lower, relatively low for a new leader, according to Japanese media. He plans to dissolve parliament on Wednesday for an election on Oct. 27.

After gaining briefly against the dollar, the yen fell back late last week. Early Monday, the dollar was trading at 148.34 yen, down from 148.72 late Friday. The euro rose to $1.0974 from $1.0967.

Elsewhere in Asia, Hong Kong’s Hang Seng index rose 1.6% to 23,099.78, and the Kospi in Seoul surged 1.6% to 2,610.38.

Taiwan’s Taiex gained 1.8%.

Mainland Chinese markets reopen from a weeklong holiday on Tuesday, and the government said it plans to explain details of plans for economic stimulus at a morning news conference in Beijing. Before the Oct. 1 National Day holiday began, announcements of policies aimed at reviving the ailing property market pushed share benchmarks sharply higher and this week could bring more volatility.

“More fiscal stimulus to stabilize the property market and restructure local government debts, and structural reforms to address the over-capacity and deflation issues are needed to turn around the economy,” B of A Securities said in a research note, pointing to continued declines in home sales, housing prices and credit growth.

On Friday, the S&P 500 climbed 0.9% and got close to its all-time high set on Monday. The Dow gained 0.8% and the Nasdaq climbed 1.2%.

Worries over tensions in the Middle East have pushed oil prices sharply higher as the world waits to see how Israel will respond to an Oct. 1 missile attack by Iran.

Monday’s surprise cross-border barrage caught Israel unprepared on a major Jewish holiday, as the nation mourned the hundreds of victims of the Oct. 7, 2023 attack, the dozens of hostages still in captivity and the soldiers wounded or killed trying to save them.

After slight losses earlier in the day, U.S. benchmark crude oil was up $1.26 at $75.64 per barrel, while Brent crude, the international standard, picked up $1.09 to $79.14 per barrel.

In Friday’s report, the U.S. government said employers added 254,000 more jobs to their payrolls last month than they cut. That was an acceleration from August’s hiring pace of 159,000 and blew past economists’ forecasts.

Recent encouraging data on the economy have raised hopes that the job market will hold up after the Fed pressed the brakes on the economy through higher rates in order to stamp out high inflation.

The Fed has begun cutting interest rates and Friday’s jobs report was so strong traders are now forecasting it will not deliver another half-point interest rate cut before the end of the year after doing so in September.