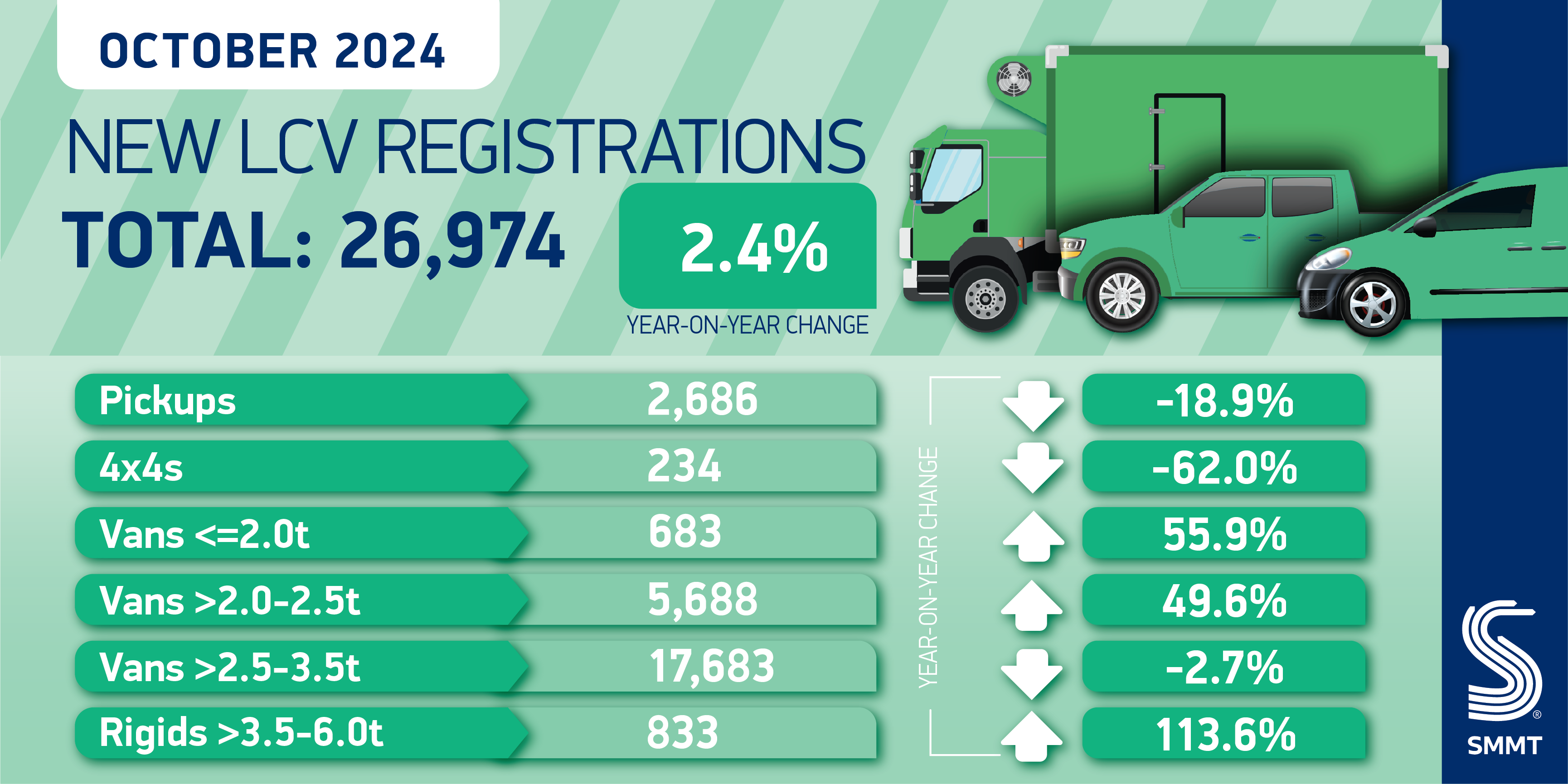

The number of new light commercial vehicles (LCVs) joining UK roads grew 2.4% in October with 26,974 new vans, pickups and 4x4s registered, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT)

The number of new light commercial vehicles (LCVs) joining UK roads grew 2.4% in October with 26,974 new vans, pickups and 4x4s registered, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). It represents the third consecutive month of overall market growth and the best October in three years.1

The growth was driven by demand for small and medium vans, up 55.9% and 49.6% to 683 and 5,688 units respectively. Uptake of large vans, meanwhile, fell by -2.7% to 17,683 units, though these vehicles still represent the vast majority (65.6%) of the market. Demand for new pickups and 4x4s also declined, by -18.9% and -62.0% to 2,686 and 234 units respectively, after strong growth a year ago.

Future demand for new pick-ups, however is now at serious risk following last week’s Budget announcement to tax double-cabs as cars for benefit in kind and capital allowances purposes beyond April 2025. The change is set to heap further costs on vital industries such as farming, construction, utilities, the self-employed and other businesses for whom these vehicles are an everyday workhorse. The industry urges government to reconsider this move, therefore, and reflect February’s decision by HMRC to avoid harming these sectors with knock-on effects for the wider UK economy.2

More positively, demand for new battery electric vans (BEVs) rose for the first time in five months, up 61.8% to 2,263 units, with new registrations of the very greenest models representing 8.4% of the whole new LCV market in October.3 Over the course of the year, however, uptake has fallen by -1.9% compared with the same period last year, accounting for a 5.6% market share – significantly below the level mandated.4

The decline is despite significant manufacturer investment to grow Britain’s BEV choice to more than 30 cutting-edge, competitive models. The extension of the Plug-in Van Grant into the next financial year is welcome and necessary, but further measures are critically needed to give more fleet operators confidence that going electric is commercially viable. In particular, the lack of chargepoint infrastructure suited to the specific needs of vans presents a major barrier for fleet operators considering the switch, and must be addressed quickly.

Mike Hawes, SMMT Chief Executive, said,

The continued growth in demand for new vans is encouraging given this sector is a barometer of the health of Britain’s businesses. Industry has invested huge sums delivering cutting-edge technology, including zero emission vehicles, but low demand raises serious doubt over the ability of the UK to achieve its ambitious green targets. There must be an urgent review of the market, regulation and support in place, else the cost will soon be felt in reduced UK investment, economic growth, jobs and decarbonisation.

1. New LCV registrations, October 2021: 24,420 units.

2. https://www.gov.uk/government/news/update-on-hmrc-double-cab-pick-up-guidance

3. SMMT’s new BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t.

4. New BEV registrations, January to October 2023: 15,658 units.

SOURCE: SMMT