[ad_1]

Kraft Heinz (NASDAQ: KHC) is a top food company in the world, but the business hasn’t been doing well in recent years. It has struggled to grow, and investors have been unloading the stock, with Kraft’s share price falling by 18% over the past 12 months. At the time of this writing, it’s trading around its 52-week low.

Here’s a look at some of the key problems facing Kraft today and what the business needs to do to turn things around.

There are many brands in Kraft’s portfolio, but one that looked to have the potential to deliver some considerable growth in the years ahead was Lunchables, its pre-packaged lunch food. The company saw a big opportunity by offering them in school cafeterias, which it estimated could be a market worth $25 billion. That’s massive when you consider that Kraft’s annual sales typically hover around $26 billion to $27 billion. Growth hasn’t been easy for the business lately, and selling Lunchables in school cafeterias could have been a huge opportunity.

I say “could” because the company recently announced it was pulling out of school cafeterias due to poor demand. A spokesperson said that “while many school administrators were excited to have these options, the demand did not meet our targets.” There have been concerns about the nutritional value of the food, as health experts worry that Lunchables are highly processed and contain high levels of sodium.

This is, unfortunately, part of a much bigger problem for Kraft, as demand for its products as a whole hasn’t been terribly strong in recent years.

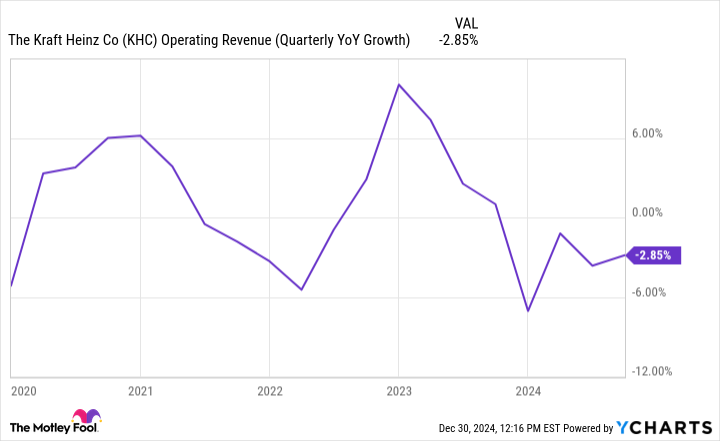

A big concern for investors is that the business isn’t generating any growth. Over the past five years, the company has struggled to consistently grow its top line. While Kraft has a wide range of brands, that diversification hasn’t proven to be much help in growing the company’s top line; in recent quarters, revenue has been declining.

As consumer attitudes shift toward healthier eating options, the company will need to adapt in order to grow its sales. Brands like Oscar Mayer, Kool-Aid, and Kraft Dinner are not exactly synonymous with healthy eating. And while sales are slowly declining today, there could be more of a drop-off in the future. Making its products healthier will be key to Kraft curbing that trend.

Kraft Heinz is a top consumer brand, and it remains one of the top holdings in the portfolio of wildly successful investor Warren Buffett. It’s still profitable and generating sufficient free cash flow to cover its dividend payments, but investors should be wary of the risks.

[ad_2]

Source link