(Bloomberg) — Back in June, a mystery investor made a record wager on long-dated Treasuries, creating waves in the ETF market where trading pros seek clues about sentiment on Wall Street. Now the firm behind that bet has revealed itself, and says its recession call is finally coming to fruition.

Most Read from Bloomberg

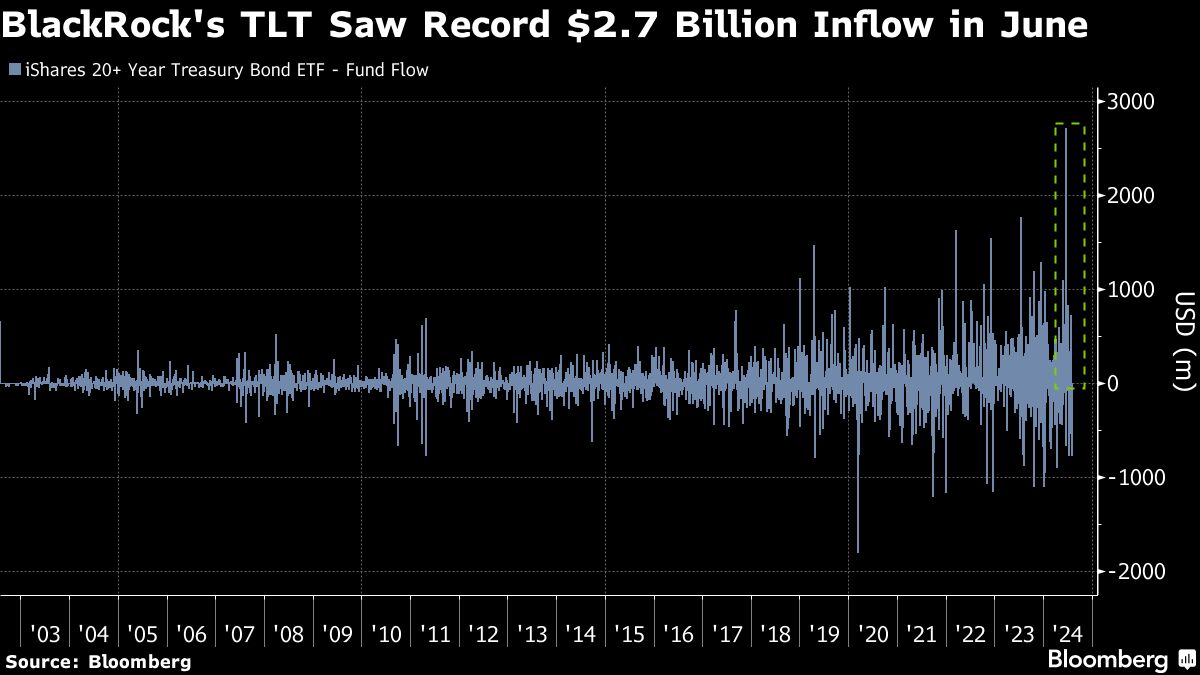

On Tuesday, Northwestern Mutual Wealth Management’s Brent Schutte said it was his company that poured $2.7 billion into BlackRock’s 20+ Year Treasury Bond exchange-traded fund (ticker TLT) on June 24, an unprecedented inflow for the largest long-bond ETF, which debuted in 2002.

Schutte, the roughly $300 billion money manager’s chief investment officer, said the plan is to hold the position across retail portfolios for at least a year, on the view that a cooling labor market will spark a recession.

His projection comes as a Treasuries rally in recent weeks vindicates his June move. Discouraging economic data and global turbulence fueled the bond gains – which have pared somewhat the past few days. The tumult, however, has cemented the view that the Federal Reserve will start lowering borrowing costs next month.

“It’s taking longer to get to a recession because of all the excesses that were pumped in the economy — the liquidity, the excess savings, the lower interest-rate environment that had allowed corporations and consumers to refinance,” Schutte said. “You’re starting to see those things wear off.”

The job market, he added, “is usually the last thing to break.”

Schutte pointed to a raft of economic figures that he says back up his case, including the rising US unemployment rate. Meanwhile, JPMorgan Chase & Co. says it now sees a 35% chance that the US economy tips into a recession this year, up from 25% at of the start of last month.

“We are going to find out in the next 3-6 months on whether or not we have one, and the reality is we may already be in one,” Schutte said about the timing of a possible recession.

The $58 billion TLT fund has gained about 1% since June 24, after paring its advance the past few days as a relative sense of calm returned to markets. It sank Thursday as fresh labor-market data alleviated some worries about the economy.

Schutte said the ETF is performing as expected, and the risk-reward set-up was attractive for owning exposure to duration, a measure of bonds’ sensitivity to interest-rate movements.

At the time of the TLT trade, the 10-year Treasury yielded roughly 4.2%, and it has since dropped to around 4%. By his calculation, if rates had risen 100 basis points from that June level in the roughly 12-month holding period he anticipates, he would have lost about 2%, but if they dropped 100 basis points, he’d reap around a 12% total return in that timespan.

“That skew to me was attractive,” he said. “The reality is that bonds have returned to more of their historical role of hedging some equity downside risk.”

Looking ahead, the investment chief expects further bouts of volatility, as seen earlier this week when investors exited carry-trade bets, and as markets react to weakening economic data.

It’s unlikely, he said, that the Fed will lower rates in September by more than a quarter-point, because officials need to be certain inflation is moving in the right direction. At this point, traders are bracing for a cut of more than that amount.

However, if the labor market shows further signs of cooling, the Fed could cut by 50 basis points, and “maybe even more,” Schutte said.

(Updates with details on bond-return calculation in 11th paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.