No income investor buys shares of a dividend-paying company expecting that it will suspend its distributions at some point. Quite the contrary, dividend investors want those payouts to keep going and growing for as long as possible — preferably forever. Unfortunately, many companies will, at some point, have to resort to dividend cuts because of business challenges.

However, in my view, Visa (NYSE: V) and Novartis (NYSE: NVS) look likely to avoid this future, and both are worth investing in and holding onto for good. Let’s look at both.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Visa, a leading payment network company, has an excellent dividend track record. It has been paying dividends since 2008 when it went public, and it has increased its payouts every year.

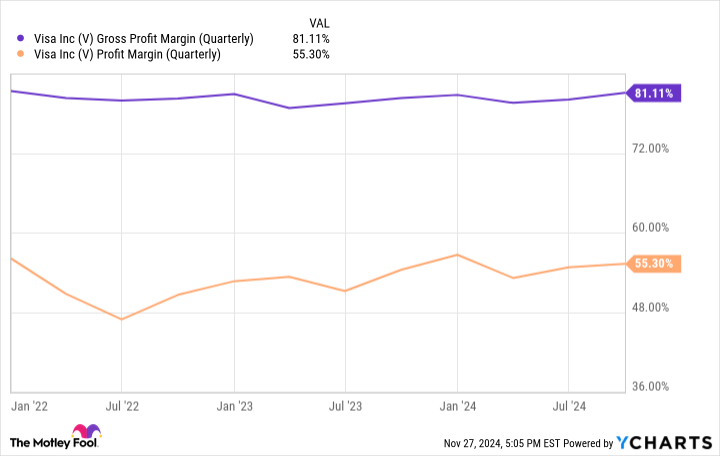

Visa can afford it: It generates consistent and growing revenue, earnings, and free cash flow. Its payment network helps facilitate hundreds of millions of credit card transactions daily, with the company taking a small cut of each. Its business also generates excellent margins. The company’s gross margins are generally around 80%, while it typically nets about $0.50 for every dollar in revenue.

That degree of profitability is rare for a company as large as Visa, but it’s not an accident. Visa’s payment network is already in place. Additional transactions add little in the way of costs, resulting in strong margins.

Further, Visa’s ecosystem of banks, consumers who carry credit cards bearing its logo, and businesses that accept those cards for payment is such that it becomes more valuable as it grows, making it a natural example of the network effect. Visa has few direct competitors of note to speak of, nor is the company letting the increased digitization of payments challenge its dominance.

The company has been adapting its business to the changing nature of the financial industry. Lastly, it should still have plenty of growth opportunities, with trillions of dollars worth of transactions still being performed outside the scope of the kinds that Visa’s network supports. The ongoing displacement of cash and digitization of payments will provide a powerful long-term tailwind to the company.

Visa is well-positioned to deliver excellent returns and consistent dividend growth throughout it all.

There is always a high demand for vital pharmaceuticals of the types that Novartis offers. It has been in the drug-making business for a long time, and its portfolio includes many “blockbusters” — drugs that generate more than $1 billion in annual sales. It routinely develops newer products to replace those losing sales to patent expirations and competition.