(Bloomberg) — Japanese stocks plunged for a second day on expectations for further monetary tightening in the country, exacerbating a global selloff following weak US economic data and tech earnings.

Most Read from Bloomberg

The Topix index fell as much as 5.7%, the most since 2020, as the yen traded near its strongest since March to weigh on Japan’s export-oriented economy. Shares also dropped across Asia from South Korea to Hong Kong, with AI chipmaker SK Hynix Inc. tumbling 8.7%.

The MSCI Asia Pacific Index declined nearly 3%, the most in over two years. US stock futures extended losses in Asia too.

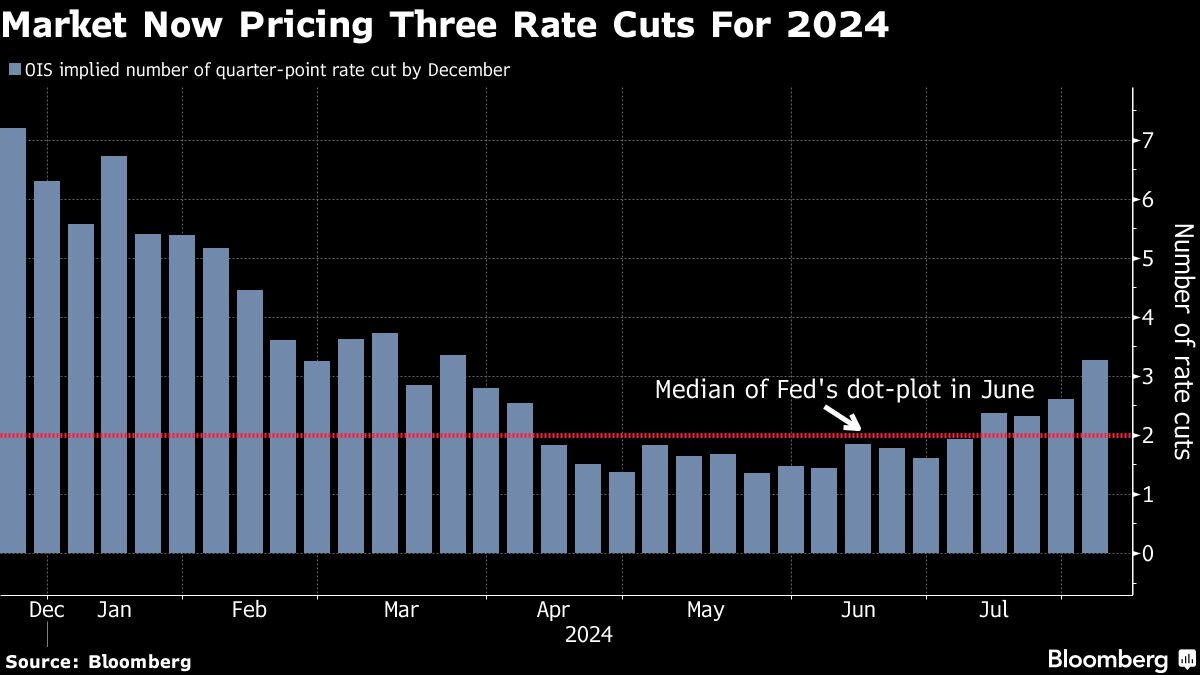

Meantime, Treasuries extended a rally in Asia, with the policy-sensitive two-year yields touching a 14-month low amid increased bets on rate cuts by the Federal Reserve following the central bank’s policy meeting on Wednesday. Swaps traders raised the number of reductions this year to three from two.

The broader risk-off tone came after data showed US weekly unemployment claims hit an almost one-year high while manufacturing shrank. The tech-led losses were inflicted by disappointing earnings outlook or results from industry behemoths such as Intel Corp. and Amazon.com Inc. The focus will now shift to the monthly jobs data later Friday.

What’s keeping investors on edge in Japan is the outlook for the nation’s central bank to hike rates further following its move earlier this week. The Bank of Japan’s big policy shift this week makes another interest rate hike highly likely in October and raises the potential for quarterly increases, according to a former executive director in charge of monetary policy.

“The recent strengthening of the Japanese yen coupled with tech sector weakness is poised to significantly impact the Asian stock market,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. “Japanese exporters are particularly vulnerable to the yen’s appreciation, as it erodes the value of their overseas earnings.”

Treasuries advanced again on Friday, with the 10-year yield extending its decline below 4%. The two-year note saw its yields fall two basis points, adding to the 11 basis-point drop the day before.

Contracts for the S&P 500 index and Nasdaq 100 index also slipped Friday, compounding Thursday declines for the underlying benchmarks, as a handful of post-market corporate reports underwhelmed. Intel said third-quarter revenue will disappoint while Amazon.com projected profits that missed analysts’ estimates, sending each companies shares lower in after-hours trading.

The yen snapped a three-day gain, a rally that had pushed the currency to around 149 per dollar. The pound slid Thursday after the Bank of England cut rates and signaled further cautious reductions ahead. A Bloomberg dollar gauge edged higher.

Aside from the yen’s recent surge, renewed worries about the health of the world’s No. 1 economy also weighed on Japanese shares.

“I didn’t expect stocks to fall this much,” said said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Asset Management Co. in Tokyo. “This is probably because there are concerns that the U.S. economy will collapse in a big way, which is the most unpleasant pattern for Japanese stocks.”

US Jobs

Economists are expecting a moderation in job growth in the government’s July employment report due Friday. Forecasters anticipate the unemployment rate remained steady at 4.1%.

“The labor market has been flashing warning signals over the past several months,” said Chris Senyek at Wolfe Research. “History suggests Powell is walking a very fine line on potentially waiting too long to start cutting rates before it’s too late.”

Elsewhere in Asia, a Chinese central bank policy adviser issued a rare critique of Beijing’s economic policies for being overly conservative, urging the government to ramp up fiscal stimulus and promote inflation. The country’s benchmark CSI 300 stock index extended losses from Thursday following a brief rally in the previous session.

In commodities, oil rose after a Thursday decline against the backdrop of concerns Middle East tensions may impact supply. Elsewhere, gold wavered near record levels.

Key events this week:

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.4% as of 9:33 a.m. Tokyo time

-

Hang Seng futures fell 1.5%

-

Nikkei 225 futures (OSE) fell 4.2%

-

Japan’s Topix fell 4.8%

-

Australia’s S&P/ASX 200 fell 1.9%

-

Euro Stoxx 50 futures fell 0.6%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0789

-

The Japanese yen was little changed at 149.22 per dollar

-

The offshore yuan was little changed at 7.2477 per dollar

-

The Australian dollar fell 0.2% to $0.6489

Cryptocurrencies

-

Bitcoin rose 0.7% to $65,148.71

-

Ether rose 1.1% to $3,203.89

Bonds

-

The yield on 10-year Treasuries declined three basis points to 3.95%

-

Japan’s 10-year yield declined six basis points to 0.975%

-

Australia’s 10-year yield declined nine basis points to 4.00%

Commodities

-

West Texas Intermediate crude rose 0.5% to $76.68 a barrel

-

Spot gold rose 0.2% to $2,452.15 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Abhishek Vishnoi and Yasutaka Tamura.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.