Sophisticated semiconductor chips known as graphics processing units (GPU) play an important role in the development of artificial intelligence (AI).

One thing some investors might not realize, however, is that chip designers such as Nvidia and Advanced Micro Devices rely heavily on outside parties for their chip distribution.

The surging demand for chips has served as a bellwether for increased capital expenditures (capex) in areas like data center infrastructure. This is where Super Micro Computer (NASDAQ: SMCI), a server-rack and equipment architecture specialist, comes into play.

Yet despite its crucial role in the AI landscape, shares of Supermicro, as it’s also known, have fallen just over 30% in the last three months.

Let’s dig into what’s driving some of the selling activity and assess why now looks like a fantastic time to buy the dip in Supermicro stock.

A look underneath the hood

There are a few key reasons Supermicro has sold off recently.

For starters, the macroeconomic outlook has been mixed. With inflation, the July reading of 2.9% represents a three-year low. While encouraging, that is still higher than the Federal Reserve’s long-term target of 2%, and mixed job reports have left investors feeling cautious. Broad-market sentiment has driven the selling activity for many stocks this summer.

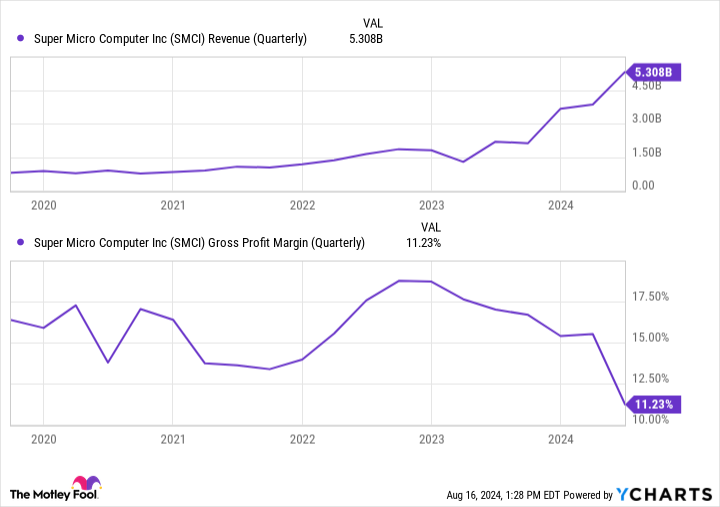

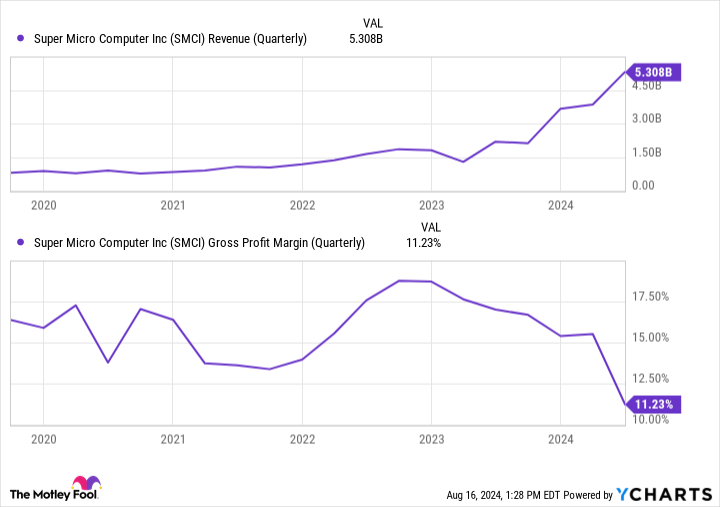

Meanwhile, at a company specific level, Supermicro generated $5.3 billion of revenue in its fiscal 2024 fourth quarter (ended June 30), an increase of 141% year over year. As you can see below, demand trends for Supermicro are strong. However, a look further down the income statement paints a different picture.

In the same quarter, gross margin plummeted to 11.2%, down from 17.0% a year ago. Operating margin also shrank about 390 basis points to 6.5%. So, while revenue has surged since the beginning of last year thanks to booming interest in AI, Supermicro’s profitability has trended in the opposite direction.

In other words, rising revenue and falling profitability metrics suggest the company is paying a hefty price for its newfound growth. A deteriorating margin profile can have adverse effects on cash flow and liquidity.

Given this upside-down financial profile, I’m not surprised to see some investors move on from the stock. Nevertheless, I wouldn’t hit the panic button just yet.

Why the sell-off looks overblown

Management addressed the challenges around the company’s margins during the latest earnings call.

Essentially, supply-and-demand dynamics in the AI realm right now are under a lot of pressure. This can lead to unpredictable lead times as it relates to costs for products, shipping, and more. For these reasons, some companies are witnessing abnormal costs that are not commensurate with revenue trends in any given quarter due to ongoing supply chain constraints.

CFO David Weigand tried to put these concerns to rest:

We expect gross and operating margins to gradually increase in the year, driven by product and customer mix, manufacturing efficiencies in new … AI GPU clusters, and new platform introductions. As [CEO Charles Liang] discussed, shipments may continue to be constrained in the short term by supply chain bottlenecks for key new components for advanced platforms. However, long-term gross margins will benefit from lower manufacturing costs as we scale up production in Malaysia and Taiwan, in addition to expansion in the Americas and Europe.

Weigand’s explanation makes perfect sense. As manufacturing capabilities achieve higher efficiencies due to new production centers in Asia, Europe, and North America, Supermicro should begin to realize a more normalized relationship between revenue and cost growth. In turn, this will improve the company’s profitability metrics over time.

Why now is a good time to invest in Supermicro

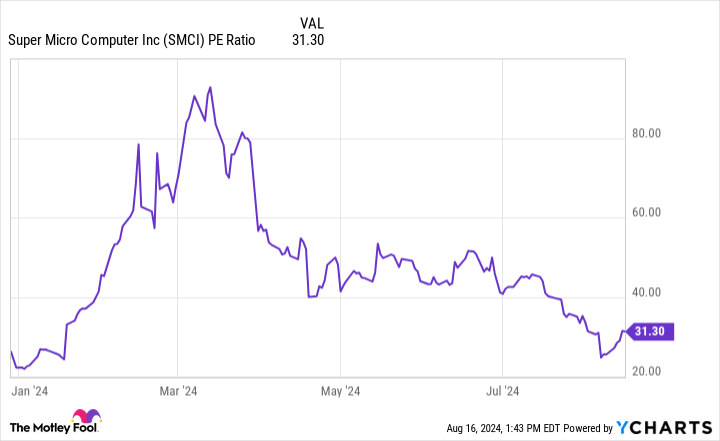

Supermicro currently trades at a price-to-earnings multiple (P/E) of 31.3. This is a little pricey, even for a growth stock, but shares trade well below their previous highs on a P/E basis.

Investing in Supermicro should be rooted in two primary ideas. First, you should have strong conviction around AI and its ability to continue driving impressive revenue growth for the company. But more importantly, you should be focused on the company’s path to improved profitability.

Considering Supermicro’s position in the IT infrastructure landscape and the ongoing secular tailwinds fueling AI, the company seems to have a winning recipe.

Investors with a long time horizon should seriously consider taking advantage of Super Micro Computer’s recent sell-off and relatively low valuation. It many not take long for the company to show margin improvements, and should that occur, the stock could easily surge back toward its previous highs.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $796,586!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

1 Beaten-Down S&P 500 Artificial Intelligence (AI) Stock Down 30% to Buy Hand Over Fist Now was originally published by The Motley Fool